Different Types of Share Capital Explained Authorized vs Paid Up capital Hindi YouTube

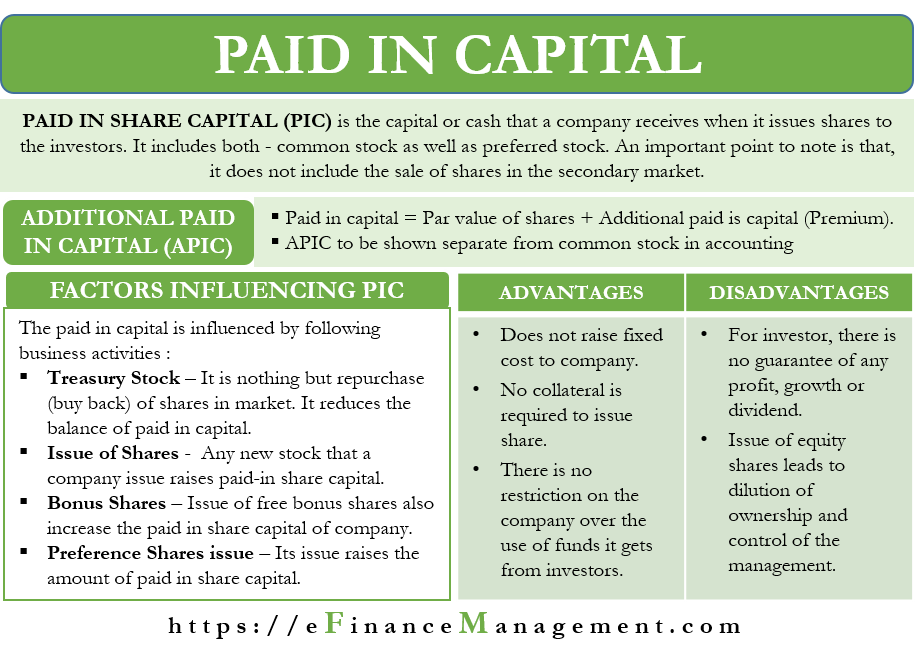

Paid In Capital: Paid-in capital is the amount of capital "paid in" by investors during common or preferred stock issuances, including the par value of the shares themselves. Paid-in capital.

Authorized Capital and Paidup Capital Finaxis

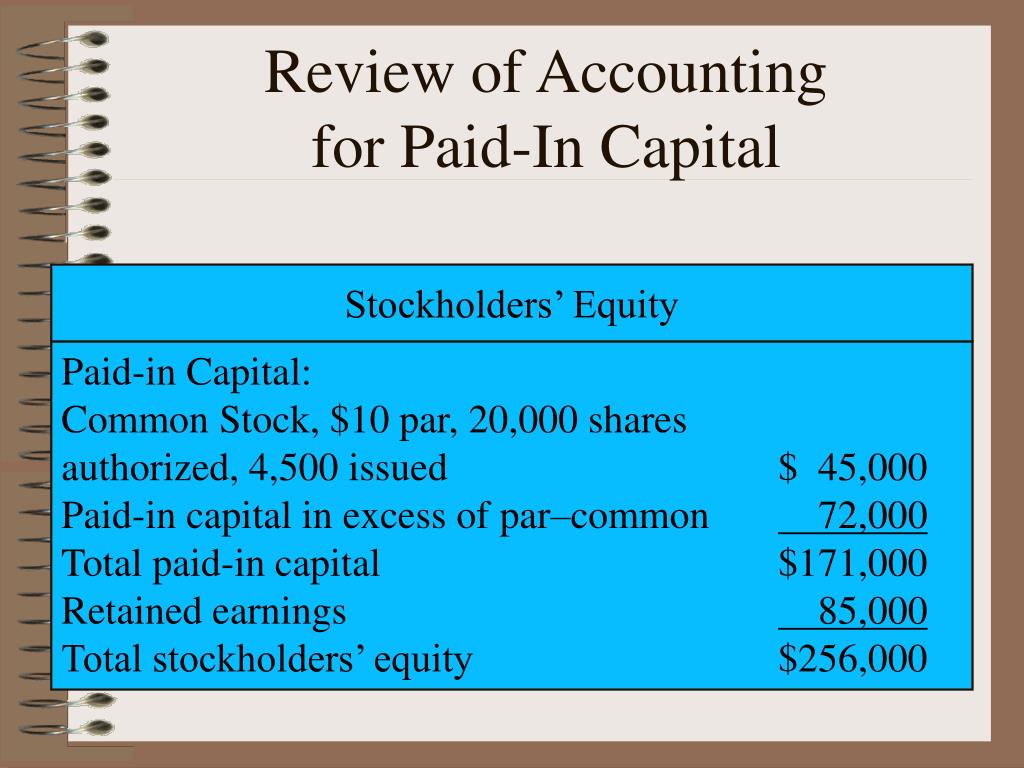

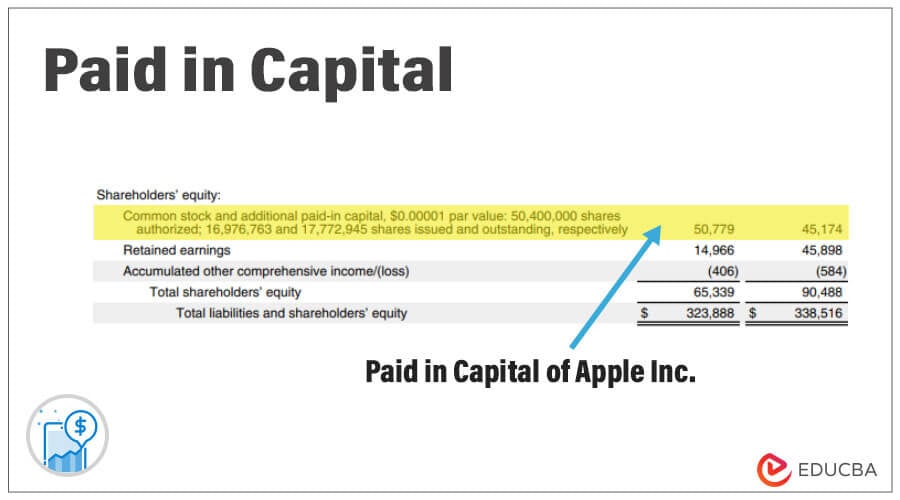

Paid-up capital is listed under the stockholder's equity on the balance sheet. This category is further subdivided into the common stock and additional paid-up capital sub-accounts. The price of a.

Paid in capital Vs. Retained Earning? What Are the Key Difference? CFAJournal

Paid-up capital doesn't need to be repaid, which is a major benefit of funding business operations in this manner. Also called paid-in capital, equity capital, or contributed capital, paid-up capital is simply the total amount of money shareholders have paid for shares at the initial issuance. It does not include any amount that investors later.

Concept and Difference of Authorised Capital and Paid up Capital Swarit

Paid-in or paid-up capital is the amount invested to own shares of a stock of a company. On the contrary, retained earnings is the net income of the firm, which it is left with after the deductions and liabilities are met. Paid-up capital is what shareholders provide to the firms with which they grow further. Retained earnings is the company.

Difference between Authorised Capital and Paid up Share Capital

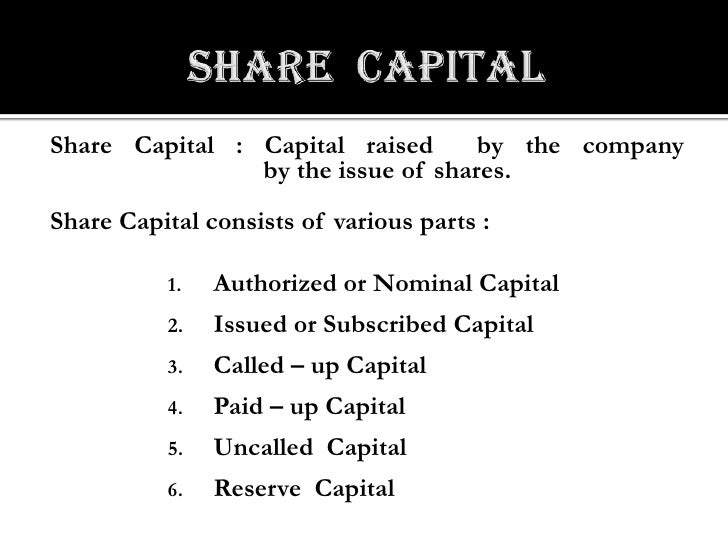

Paid-up capital is a key indicator of a company's reliance on equity financing and financial stability. Authorized capital represents the maximum amount a company can raise through stock sales. Show Article Sources. Paid-up capital, also known as paid-in capital, plays a crucial role in a company's financial structure. This article explores the.

Additional Paid In Capital Definition, Calculation & Examples

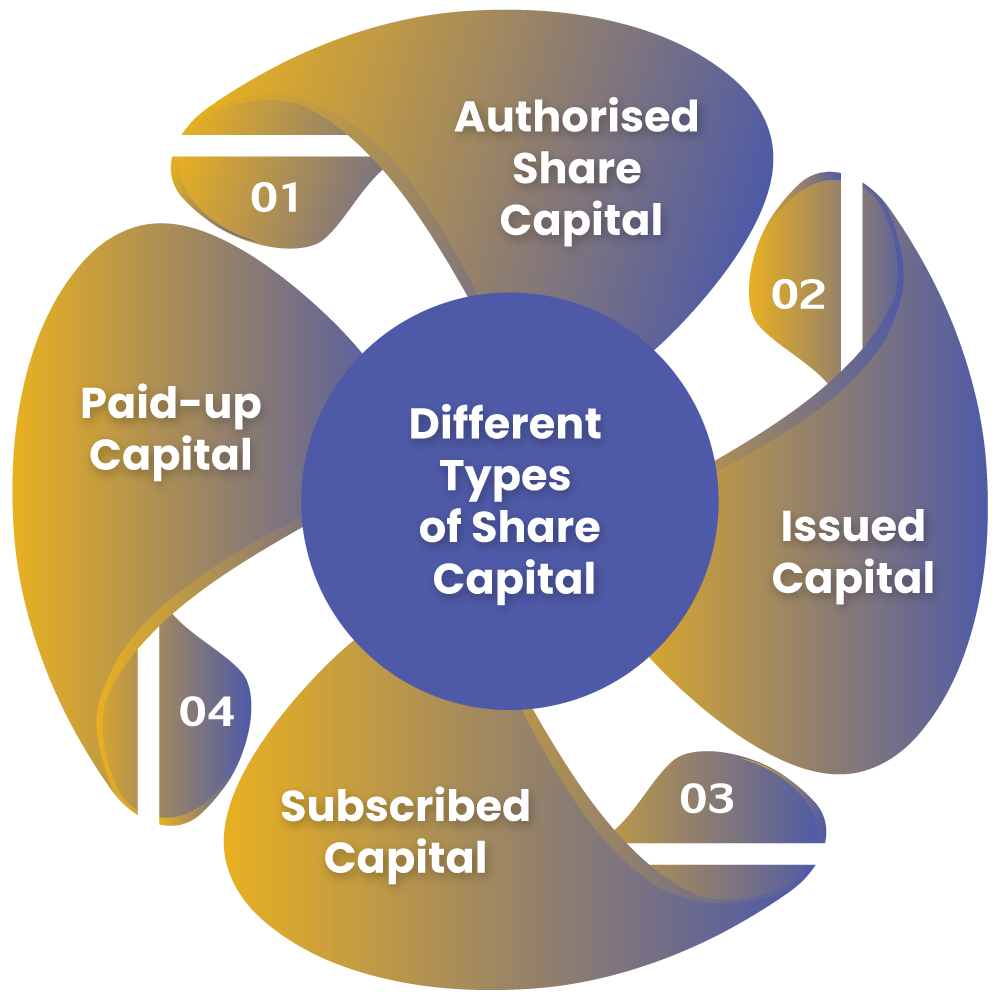

Japan. Paid-in capital (also paid-up capital and contributed capital) is capital that is contributed to a corporation by investors by purchase of stock from the corporation, the primary market, not by purchase of stock in the open market from other stockholders (the secondary market).It includes share capital (capital stock) as well as additional paid-in capital.

Comparison Between Authorised Capital and Paid up Capital Provenience

A company's paid-up capital figure thus represents the extent to which it depends on equity financing to fund its operations. This figure can be compared with the company's level of debt to assess.

Authorised Capital vs Paid Up Capital Know The Difference Taxtolegal

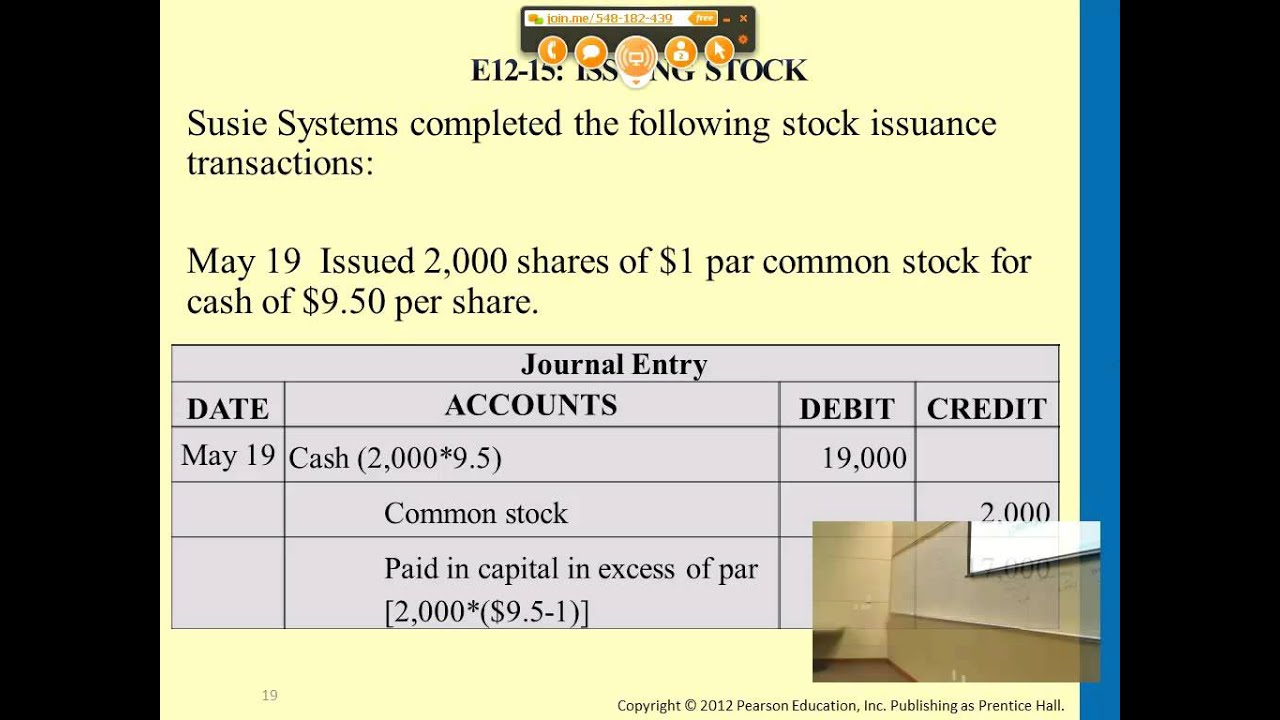

This is the price at which the stock is sold above par value. The formula for paid-in capital is as follows: Paid-in capital = Par value + Additional paid-in capital. An alternate interpretation is that additional capital paid equals already paid, excluding par value from the definition. So, when discussing paid-in capital with others who might.

Additional Paidin Capital What It Is, Formula and Examples

:max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png)

Paid-in capital is the sum of all dollars invested into a company. It is also referred to as "contributed capital.". You can calculate paid-in capital by adding common and preferred stock with additional paid-in capital or capital surplus on the balance sheet. Paid-in capital can be reduced by treasury stock when a business buys back shares.

PPT Corporations Paidin Capital and the Balance Sheet PowerPoint Presentation ID7106187

Additional Paid-In Capital (APIC) = $100,000 − $100 = $99,900; In conclusion, the total paid-in capital from our hypothetical transaction is $100k, composed of $100 in common stock (par value) and $99.9k in additional paid-in capital (APIC). Paid-In Capital = $100 + $99.900 = $100,000; How to Find Paid-In Capital on the Balance Sheet

Paidin Capital Meaning, Advantages Disadvantages and More

Paid-up capital comes from two sources - the face value of the stocks, and any excess capital paid on top. The face value (or par value) is the base price issued by the company. This is usually very low and does not necessarily reflect the market value of the shares in real terms. This value is listed as common stock on the shareholder equity.

Paidin Capital & Balance Sheet Financial Accounting C12 Professor Chiu YouTube

Paid-in capital is the total funding a company has received by selling its stock shares. There are two components to paid-in capital: par value and additional paid-in capital. Par value is a stock.

PaidUpCapital and Stated Capital Of a Corporation Kalfa Law Firm

Paid-up capital is the amount of money a company has received from shareholders in exchange for shares of stock. Paid-up capital is created when a company sells its shares on the primary market.

Paid in Capital How to Calculate a Paid In Capital BalanceSheet?

The difference between called-up share capital and paid-up share capital is that investors have already paid in full for paid-up capital. Called-up capital has not yet been completely paid, though payment has been requested by the issuing entity. Share capital consists of all funds raised by a company in exchange for shares of either common or.

What is Authorized Capital, Issued Capital and PaidUp Capital? Explained! YouTube

HoneySlam can also credit common stock or paid-in capital for $200,000, and the additional $1.7 million will be credited as additional paid-in capital. Frequently Asked Questions. What is the difference between paid-in capital and retained earnings? First, paid-in capital and retained earnings are the major categories of stockholders' equity.

Paid Up Capital Meaning / What is Paid up Share Capital YouTube Businesses must request

Suppose investors subscribe and fully pay for 50,000 equity shares at the face value of ₹10 per share. Then according to the paid up capital formula, the paid up capital of a private company named XYZ Pvt. Ltd. would be: Paid-up Capital = Number of Shares Issued × Face Value. = 50,000 shares × ₹10 per share. = ₹5,00,000.

.